The way borrowers repay their federal student loans has changed dramatically over the past several years. It used to be that borrowers could only repay over different periods of time—they’d make equal payments for somewhere between 10 and 30 years or follow a set path where they paid less at first and more as time went on.

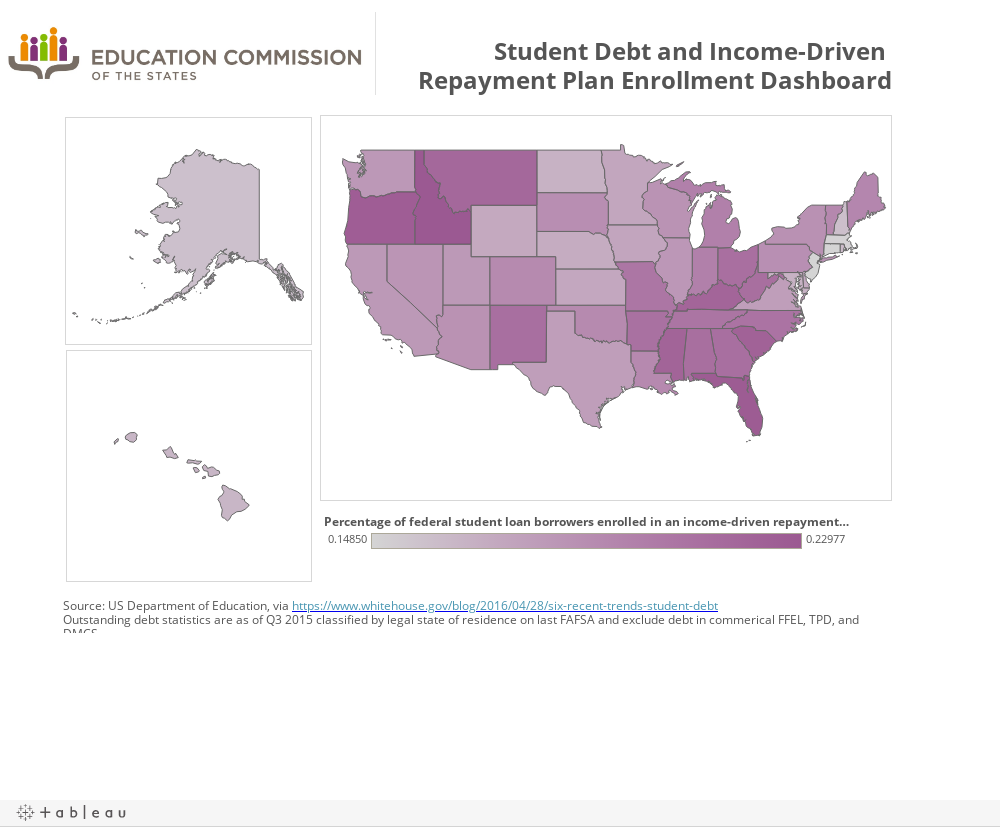

But as new federal data show, student loan borrowers are increasingly choosing a different path—to repay their loans based upon their income. Updated data from the Department of Education show that nearly one in five Federal Direct student loan borrowers have opted-in to an income-driven repayment plan. Among loans made directly by the federal government, $232.5 billion across 4.6 million borrowers is being repaid on an income-driven plan.

Income-driven repayment options are an important lifeline for struggling borrowers. By tying payments to how much borrowers actually earn they are guaranteed that loan payments will not occupy a disproportionate share of their earnings. Borrowers also get a light at the end of the payment tunnel—those that make payments for 20 years can earn forgiveness, half that time if they work in public service.

Despite the importance of income-driven repayment options, there has been little information about who is using the plans. We have no data on how usage of income-driven repayment plans varies by state or type of borrower—such as those who are older, went to graduate school, are the first in their family to attend college or other important characteristics. But new department data provides one key piece of additional information—how use of income-drive repayment plans varies by state. It shows sizable, albeit not gigantic, variation.

While this new data show that rates vary slightly across states, how should states interpret their own rates, and the difference across states? To respond to this important question, a variety of possible drivers of income-driven repayment plan enrollment should be examined, both nationally and at a state level. This includes looking at the connection between income-driven repayment and:

- The cost of higher education.

- Within and across states, is the cost of higher education related first to debt accrual, and second to the repayment plan choices that students make?

- Postsecondary program completion and employment and earnings outcomes.

- Could enrollment in income-driven repayment be linked with student completion status, or with employment outcomes?

- Institutional practices.

- Are individual or systems of institutions engaged in efforts to help students learn about income-driven repayment options, and does this effect enrollment rates?

Better understanding these plans matters a great deal. Since the 2000-2001 academic year, the percentage of bachelor’s degree recipients borrowing loans in four-year institutions has steadily increased; in the 2013-2014 academic year, a full 60 percent of bachelor’s degree recipients left college with debt. Many students who do not complete a credential also leave with loans, in fact, research indicates that these borrowers are perhaps the most vulnerable to loan delinquency and default. Income-driven repayment is one crucial but not fully understood way to tackle this challenge.