When I worked for the Commonwealth of Virginia, I was offered a variety of health benefit plans sponsored by the state. All had great coverage options for different healthcare needs and incredibly affordable premiums. I had better, and less expensive, coverage than friends working in the private sector. And because Virginia offers similar benefits to teachers, I assumed most states provided teachers with easy-to-choose-from, inexpensive, quality health plan options.

We all operate under presumptions based on our own experience, and later in my career, I found I’d been wrong. In researching teachers’ working conditions and supports, licensure rules, effectiveness measures and compensation, I noticed a lack of comprehensive information on full compensation packages for teachers. Salaries are important, but they’re only one part of the package offered to any professional. As I dug deeper into the data, I learned that teachers’ compensation packages are not nearly as high-quality as one might assume in every state.

For the last two years, the Southern Regional Education Board has published data on teacher salaries, health benefits, retirement benefits and take-home pay, showing differences across the 16-state SREB region (AL, AR, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV). To our knowledge, this database is the only one of its kind comparing these data points across states, and the only one showing detailed information on state health benefit plan options for teachers.

There are a few key takeaways when looking at health benefits across state lines in the South. First, most states offer at least two state-sponsored plans. A few permit teachers to choose from additional regional or local plans. Half of the states in the data analysis offer two or three plans — typically at least one PPO option and one HMO or HDHP plan option — while the other half may offer as many as four to 12 state plan options.

The diversity of plan offerings results in wide variations in plan premiums, deductibles and out-of-pocket expenses. Let’s look at an aggregate cost analysis for the region. The following table shows the average and median costs across all plans offered by the states in our region:

Median Costs Across States in the SREB Region

| SREB States, 2020-21 | Premium | Deductible (In-Network) | Out-of-Pocket Max |

| Individual plan average cost | $139 | $1,732 | $4,730 |

| Individual plan median cost | $92 | $1,300 | $4,400 |

| Family plan average cost | $629 | $3,286 | $10,079 |

| Family plan median cost | $581 | $2,775 | $10,000 |

Source: SREB Teacher Compensation Dashboard. View this dashboard to compare costs by state and by each plan in all 16 states of the SREB region.

Of the variations in plans across the region, it’s important to note that:

Of the variations in plans across the region, it’s important to note that:

-

- The lowest individual premium costs to teachers are not equal across states. Some states offer plans at individual premiums of $0 (MS, OK, VA), while one state’s minimum premium is $378/month (TX).

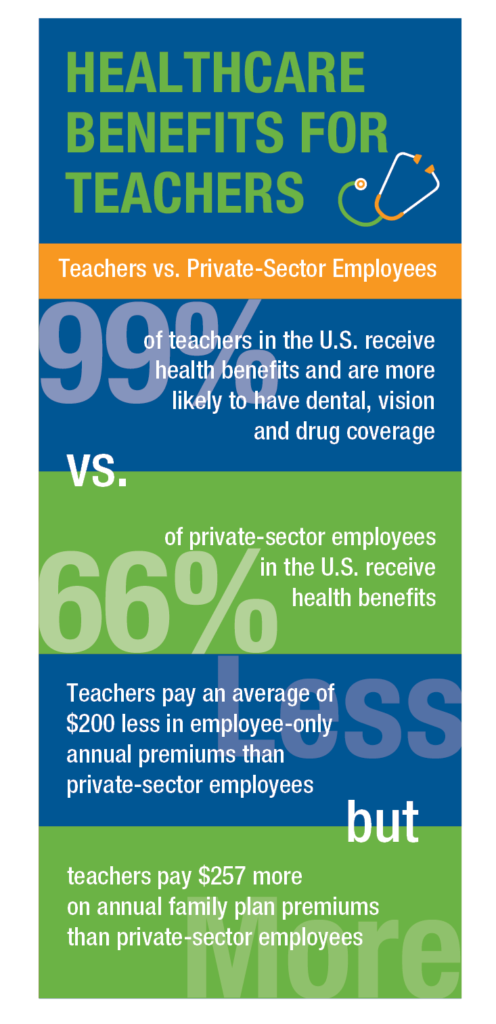

- While in most states individual health premiums for teachers are lower on average than for other highly educated professions, family premiums are higher.

- Ten states in the region offer additional coverage options such as vision, dental or life insurance for all health benefit plans offered.

- Two states in the region have plans that require an additional prescription deductible for teachers. Mississippi’s is $75, while Louisiana’s is $1,500 on top of the regular plan deductible.

All in all, teachers are provided high quality health insurance options in most states, and most states offer individual plans at lower costs than the private sector. Fewer states offer family plans at lower costs on average than the private sector though, so this could be a growth point for those looking to improve their health benefits.

However, as health insurance costs rise across all sectors, states must be diligent in planning ahead. Covering rising costs and keeping premiums affordable for teachers could help states maintain this asset in their teacher compensation packages.

Keep your eye out for the final post in this series where Ben Erwin will highlight actions states have taken to support teacher compensation in addition to salary, retirement and benefits.